Vendor:

Founded:

Headquarters:

SurePayroll

2000

Glenview, IL

Customers:

Deployment Model:

Free Trial:

670,000

Cloud

No

SurePayroll At A Glance

Product Overview

SurePayroll is a full-service online payroll solution that’s targeted toward small businesses.

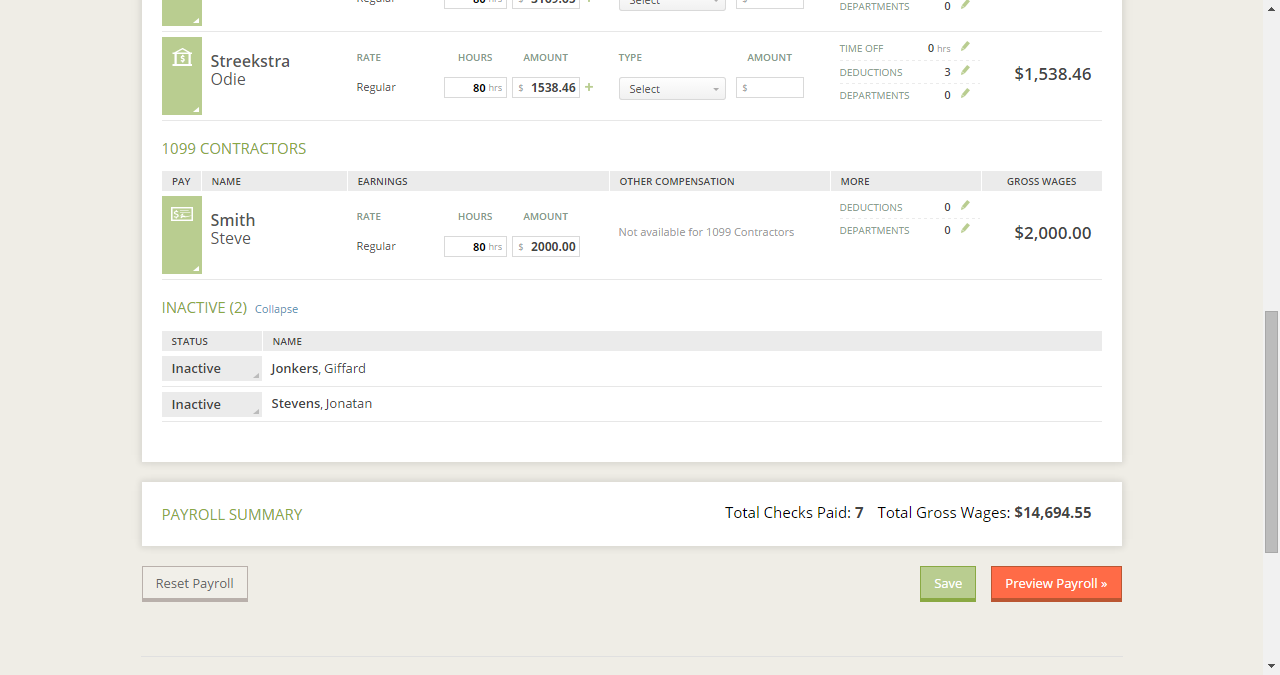

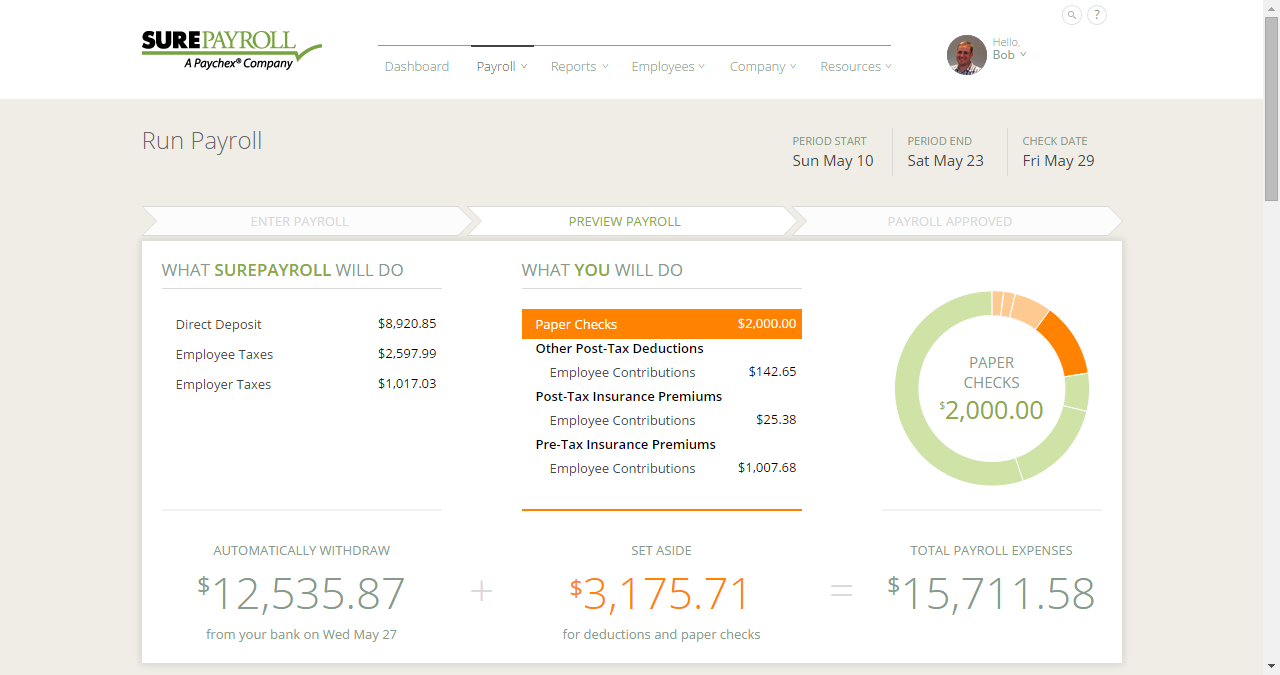

Payroll is completed in a three-step process where users can simply enter employees’ hours and approve the payroll amount. The pay then is directly deposited in employees’ bank accounts. Businesses don’t have to worry about calculating withholding amounts and deductions, as that’s done automatically. Users can also process payroll at any time from a PC or a mobile device.

In addition to easy and quick payroll, other benefits include:

- Full-tax management services, such as filing and paying federal, state and local taxes on the company’s behalf, posting W2 and 1099 forms online, and resolving disputes with the IRS

- Security

- Affordability, as pricing is calculated based on number of employees and payroll frequency

SurePayroll offers optional add-ons for 401(k), health insurance, pre-employment screenings and workers’ compensation. The payroll company also has a dedicated solution for accountants who are processing payroll for their clients.

Features

SurePayroll provides the following standard features:

One-click payroll. Users can process payroll in one click; once payroll is approved, employees receive their paycheck via direct deposit (there’s also an option to print out checks). SurePayroll sends an email confirmation that payroll is approved and handles any deductions, including those for benefits. Users can also download online payroll reports.

Mobile app. SurePayroll is available as a mobile app, so businesses can run payroll from anywhere. Within the mobile app, users can process payroll, access employees’ information, stay on top of deadlines and view previous payroll reports. There’s also an employee app that allows employees to access their current and previous paychecks.

SureAdvisor Center for Federal & State Labor Law Compliance. The purpose of SureAdvisor is to help companies adhere to federal and state labor laws. It provides downloadable compliance posters, how-to guides, customizable business templates and alerts of compliance deadlines.

Integration with accounting systems. By integrating with accounting systems, the business can post employee payroll information to the general ledger with a few short clicks. It saves time with having to manually enter payroll the second time and with looking up previous payroll information. SurePayroll integrates with Xero, Intacct, Sage 50, Quickbooks and others.

Integration with time & attendance system. SurePayroll integrates with a time and attendance system, which eliminates the need to manually enter payroll information twice. Users simply import data from their time-clock solution and add other earnings, if needed.

Target Market

SurePayroll is intended for small businesses in many different industries, such as insurance, health care and legal.

We’ve listed 10 of its customers below:

- 1st Independent Leasing, Inc.

- ABR Industries

- Basement Ventures

- Debbie's Cleaning Service, LLC.

- Engage Marketing

- Flylight Media, Inc.

- Hope Presbyterian Church

- Rochester Fireplace, Inc.

- Seagrass Inc.

- State Farm

Download Now: The Payroll Software Buyer's Guide

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

Prospective customers can enroll in SurePayroll online. After paperwork is completed and approved, they can begin processing payroll within five business days.

SurePayroll’s Customer Service staff provides enrollment assistance and a free walk-through for processing the first payroll.

Customer Service & Support

Users can contact SurePayroll via phone, chat or email. They can also access articles, videos and other resources on SurePayroll’s site.

Customer service is provided in both English and Spanish. Also, if companies have issues with the IRS (on federal, state and local levels), SurePayroll works with them on the company’s behalf.

Pricing

SurePayroll doesn’t publicly release their pricing information. Please contact the vendor directly for a quote.

How Much Does Payroll Software Cost?

Download our free report to compare pricing on 5 popular Payroll Solutions including Gusto, Zenefits, and Patriot Software.Download NowShortcomings

SurePayroll isn’t intended for larger businesses, so we recommend they check out our other payroll reviews, such as ADP.

Screenshots

About

SurePayroll, Inc., is a leading provider of online payroll and related services, including 401(k), workers’ compensation insurance, pre-employment screening and health insurance, for U.S. small businesses, CPAs and bookkeepers. An independent subsidiary of Paychex, Inc., SurePayroll founded the online payroll industry in 2000. Together, SurePayroll and Paychex together serve more than 670,000 small businesses.

Download Comparison Guide