Vendor:

Founded:

Headquarters:

CheckMark Inc.

1984

Fort Collins, CO

Customers:

Deployment Model:

Free Trial:

12,000+

Cloud, On-Premise

Yes

CheckMark Payroll At A Glance

Product Overview

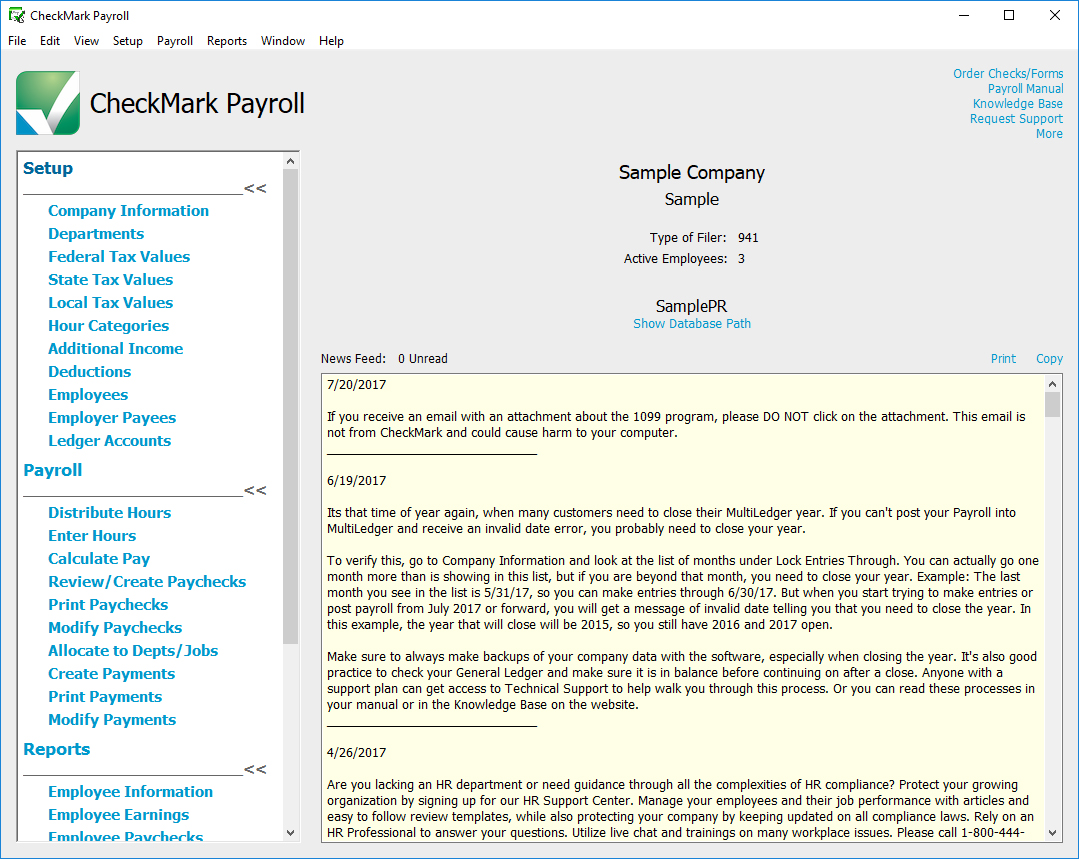

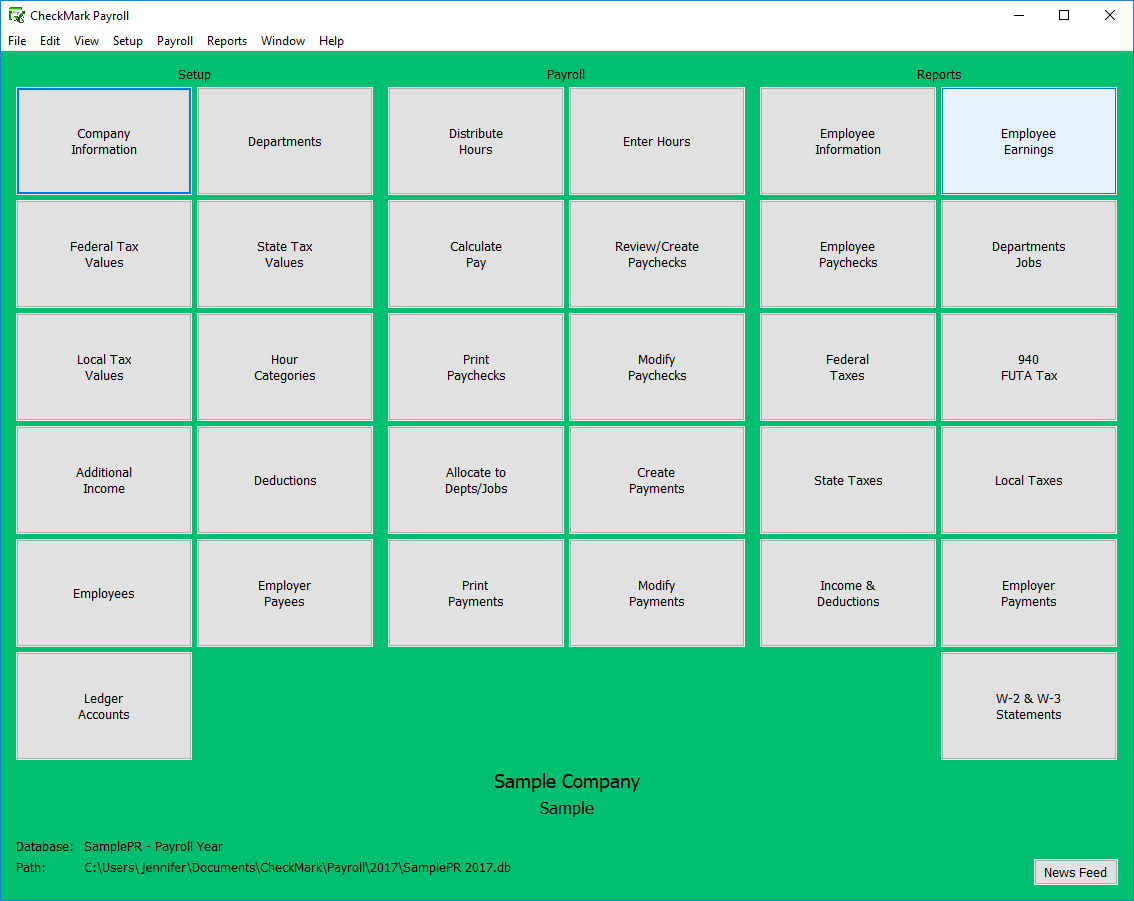

CheckMark Payroll is intended for small businesses that want a DIY payroll solution. It’s available for both Mac and Windows systems, and it can be integrated with other accounting software, such as CheckMark’s MultiLedger product.

This software is for a company that would rather have an on-premise solution instead of paying a monthly subscription cost. All a business would have to pay for is the cost of the software. Support is included with the purchase.

CheckMark Payroll has intuitive interfaces. For example, one interface used for entering employee hours resembles a spreadsheet.

CheckMark Payroll has the following system requirements: 100 MB available disk space, 512 MB of memory and a compatible printer. PCs should use Windows 8 or higher; Intel-based Macs should be using at least OS 10.6.

For companies that want more help handling payroll, CheckMark offers its own payroll services, including processing payroll and filing and paying taxes.

CheckMark now has an online payroll version, CheckMark Online Payroll, for companies that prefer the software hosted in the cloud. It includes many features, such as unlimited payroll runs, flexible payroll options, year-end tax filing, an employee self-service portal and three-day ACH processing.

Features

CheckMark Payroll has many features, such as:

- Federal and state withholding tax tables that are updated with new tax changes

- User ability to define deductions and income

- Spreadsheet-like interface for entering employees’ hours

- Ability to import hours from a time and attendance solution

- Payroll processing for an unlimited number of employees at no additional cost

- Ability to print MICR checks

- Ability to email direct-deposit statements/paystubs to employees

- User export of reports in spreadsheet or text file formats

Target Market

CheckMark is intended for small to medium-sized businesses in many different industries, such as:

- Accounting

- Churches

- Restaurants

- Health care

- Retail

- Nonprofits

- Manufacturing

Download Now: The Payroll Software Buyer's Guide

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

CheckMark Payroll is available as a 60-day free trial. However, customers can order the software on its website.

The 2023 version is now available, however, companies can also opt to purchase the 2022 version for end-of-fiscal-year tax and reports.

For CheckMark Online Payroll, there’s a 14-day free trial that doesn’t require a credit card. Once the trial ends, customers will be asked to sign up for a paid plan and provide payment info.

Customer Service & Support

CheckMark offers two support plans for its desktop product:

- Pro Support – Previously known as Professional support, this plan gives customers phone, email and chat support for all CheckMark products for up to a year or 90 minutes, whichever comes first. Online access to program fixes, as they become available, is also included.

- Pro+ Support – For one convenient fee, customers receive top-of-the-queue priority, reduced rates for data recovery services and peace of mind. Previously known as Priority Support, this plan offers phone, email and chat support for up to a year or 300 minutes, whichever comes first, for all CheckMark products. Plus, they’ll provide online access to program fixes as they become available. The plan also includes exclusive Pro+ Support Live Chat.

Additionally, CheckMark offers a product manual and payroll resources on its website.

CheckMark Online Payroll customers get free email, chat and phone support during normal business hours.

Pricing

CheckMark Payroll software starts with $549, which includes the Pro support package. Companies that want Pro+ support will expect to pay $619.

The cloud-based version has two pricing tiers. The Small Business Payroll tier, intended for organizations with up to 99 employees, starts at $24 per month ($20 per month base price plus $4 per employee, per month). Then, there’s a Mid & Large Business Payroll tier for companies with 100 up to 999 employees that adds on features, such as a lifetime volume discount, a dedicated account manager, premium support (email, phone, live chat), setup and onboarding assistance and role-based access control. Pricing for this tier is not currently available, but the vendor indicates that it will be announced soon.

How Much Does Payroll Software Cost?

Download our free report to compare pricing on 5 popular Payroll Solutions including Gusto, Zenefits, and Patriot Software.Download NowShortcomings

CheckMark Payroll is only intended for U.S. companies, so it doesn’t support international payroll. However, the vendor does offer a dedicated payroll solution for Canadian companies.

Screenshots

About

CheckMark, Inc. rolled out its first product, General Ledger accounting software for Mac users, in 1984. CheckMark Payroll was launched in 1986 for Mac users with a Windows version debuting in 1998.

In addition to payroll and accounting software, CheckMark sells 1099 software, payroll solutions for Canadian companies, and paper products such as checks and envelopes, tax forms and other business forms.

In 2011, CheckMark launched its Service division, providing payroll and accounting services, time and attendance solutions, and an online HR support center.

Download Comparison Guide