Vendor:

Founded:

Headquarters:

Tipalti

2010

San Mateo, CA

Customers:

Deployment Model:

Free Trial:

3,000+

Cloud

No

Tipalti At A Glance

Product Overview

Tipalti is an accounts payable (AP) solution that automates a company’s invoicing and payment processes. The AP process is streamlined, which improves productivity and frees up time for accounting and finance teams to focus on other initiatives. Users also won’t have to worry about inaccurate data or payment errors.

Tipalti has a multi-entity architecture that supports companies with multiple locations, brands, business units and AP workflows. It has flexible features, such as multiple currencies, multiple payment methods, unlimited number of entities supported and automatic data consolidation. Tipalti scales across the enterprise, so businesses can expand their AP operations without adding more resources.

Tipalti has several additional benefits, including:

- Real-time payment reconciliation and multiple layers of data extraction eliminates use of spreadsheets

- Improved relationships with suppliers and vendors as Tipalti offers them a self-service onboarding portal and early payment functionality

- Reduced risk of financial and non-compliance issues due to Tipalti’s features preventing fraud and keeping companies updated on regulation and other changes

Tipalti also has an expense management solution that lets finance teams efficiently reimburse their employees’ expenses. Employees can capture receipts and submit expenses in the Tipalti mobile app for their manager’s or finance team’s approval. Because the expense management tool integrates with other Tipalti modules and the company’s ERP software, it automatically reconciles the reimbursed expense again the general ledger. Finance teams can also track their company’s spend in real time.

For companies that want greater spend control, Tipalti offers a Tipalti Card payment card program. Tipalti Card is available as a physical or virtual credit or debit card, and finance teams can set the spend limits and other preapproved categories. General ledger codes are applied to each card, which helps Finance automatically reconcile expenses. Finance can determine the card to be used as a single time or for ongoing expenses, as well as cancel cards at any time.

Features

Tipalti includes these following modules:

Supplier management – The supplier management module is an onboarding self-service portal where vendors, suppliers and other payees provide payment, contact and other information upfront. The supplier also has access to payment history and status, which eliminates the need for a company’s AP department to research payment issues.

Companies have the choice of either hosting the portal via a white-labeled iFrame or having Tipalti host it. The portal can be customized to reflect the payer’s brand.

Tipalti automatically assigns unique vendor IDs to prevent duplicates. It also has a proprietary rules engine that’s driven by 26,000 global rules and identifies any payment errors before payments are made. The module supports international payments and up to 11 languages.

Finally, there’s a tax form selection wizard that allows the supplier to select and fill out the correct tax form. The software then verifies that appropriate details are accurate.

Tax compliance – This module helps companies stay in compliance with tax and other regulatory bodies. It integrates with the supplier management portal, so suppliers can fill out the requested W-9 or W-8 forms before receiving payment. The tax form collection process is automated, so there’s no paper scanning, emailing or signatures required. The software calculates the 1099 and 1042-S year-end tax forms, as well as the correct withholding. And finally, Tipalti includes Taxpayer Identification Number (TIN) matching.

Invoice management – When a supplier emails or uploads invoices, Tipalti scans and captures the data. Using built-in optical character recognition (OCR), the software extracts and pre-populates the data. It also looks for any data changes and stores this information for future use.

Other features are automatic PO matching, coding and approval prediction, scheduling batch invoices for payment and automatic reconciliation of supplier payments. It also has configurable workflows that support unlimited invoice approvers and multi-tier approvals.

Global payouts – The global payment system supports 196 countries in 120 currencies across six payment methods. The AP staff can pay multiple vendors in bulk from a single screen rather than individual bank portals. They simply upload their payment files into Tipalti, which automatically remits all payments. Payment data is then reconciled and sent to a company’s enterprise resource planning (ERP) system.

Tipalti takes care of any regulatory screening before every outbound payment to prevent fraudulent payments. It screens the payee and transaction against the Office of Foreign Assets Control (OFAC) and Specially Designated Nationals (SDN) databases for any blacklists or sanctions.

Tipalti also provides payment transparency to the suppliers, such as informing them if a payment fails or a tax form isn’t successfully uploaded.

Early payments – Tipalti offers early payment functionality, where companies can pay their suppliers earlier in exchange for a discount on payment. The AP staff can determine which suppliers (either individually or in bulk) to offer this option, the discount and the deadline from the software. The software calculates the offer based on the payment due date on the invoice. The supplier accepts the offer via the self-service portal.

An additional benefit of this feature is that the company can increase its revenue by receiving a referral fee from Tipalti for every dollar that’s paid early.

Payment reconciliation – In this module, users consolidate multiple entities, locations, accounts or payment methods in one report. Users can drill down into transaction details and filter reports by date, account or payment. The software integrates with ERP or accounting systems so payment details automatically go in those systems without manual data entry. Reports are also downloadable to Excel for further analysis.

Target Market

Tipalti targets mid-market companies, especially multi-entity companies or companies that need to pay suppliers or send money internationally. Some of its clients are in digital industries, such as media, online marketplaces, affiliate marketing or ad technology.

We’ve listed several of Tipalti’s clients below:

- Canva

- Create Music Group

- GoDigital

- Lucidworks

- Noom

- Roblox

- Skillshare

- Therabody

- Younique

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

New clients work with Tipalti’s dedicated implementation and customer success management teams on software deployment. Depending on the complexity of the project, the timeline runs from 20 minutes to a couple of weeks.

Tipalti has a five-stage implementation methodology that consists of:

- Prepare – Tipalti and the new client go over any technical requirements, onboarding plans and end-to-end workflows. The client has the opportunity to test Tipalti in a sandbox environment.

- Implement – Tipalti sets up the hosting portal, sets up a sample payment file and configures any banking and other integrations. Weekly status calls are conducted at this stage.

- Train – Tipalti provides in-depth training on all of its features.

- Launch – The software goes live. Tipalti provides assistance in payee onboarding and troubleshooting issues.

- Optimize – The customer success team works with the client on long-term goals, issues and best practices with the software.

Tipalti has pre-built integrations to accounting and ERP systems, such as NetSuite and QuickBooks Online. It also has a full-featured API that handles complex data sources. In addition, it includes pre-built performance marketing integrations, such as HitPath and Paladin, for digital media companies.

Customer Service & Support

Tipalti provides phone, email and knowledge base support.

Pricing

Tipalti’s pricing varies based on clients’ needs and which features they require. Please contact the vendor directly for a quote.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

Tipalti mainly focuses on accounts payables, so it doesn’t offer other accounting features. But it can integrate with other accounting or enterprise resource planning systems.

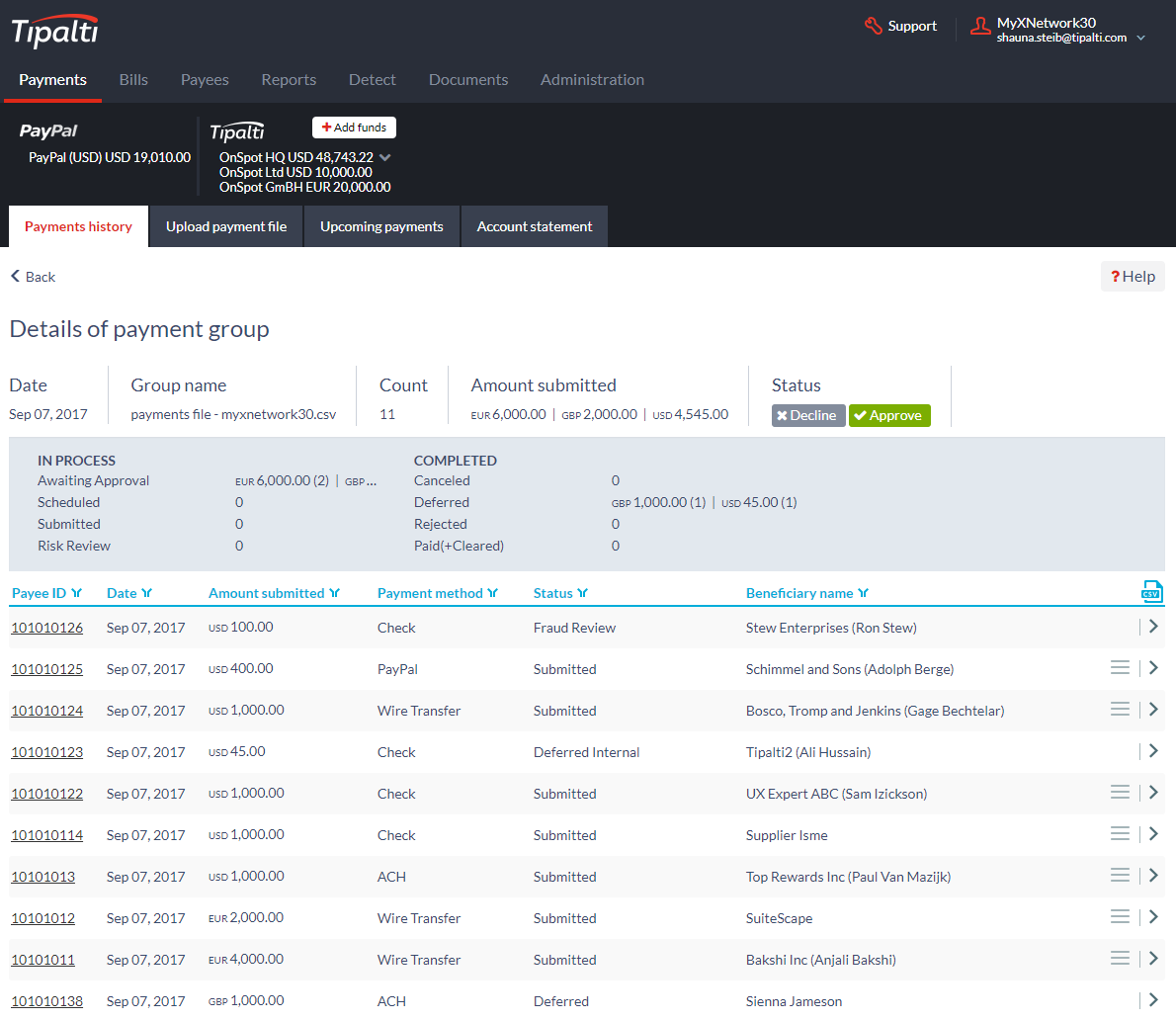

Screenshots

About

Tipalti began as an opportunity to help digital media networks streamline mass payments to global publishers. It quickly adapted to assisting with remitting global partners in the digital economy (freelancer networks, online marketplaces, etc.) and also serves companies who need to process and pay bills.

Before Tipalti, there was no technology available to help companies manage their cross-border, B2B mass payments at scale. Instead, most businesses were forced to hire additional staff – in effect, paying people to pay people.

Download Comparison Guide