Vendor:

Founded:

Headquarters:

Sage Intacct

1999

San Jose, CA

Customers:

Deployment Model:

Free Trial:

22,000+

Cloud

Yes

Sage Intacct At A Glance

Product Overview

Sage Intacct is a cloud-based accounting and financial management solution that helps improve productivity for CFOs, controllers and accountants by automating common finance tasks. It’s a scalable solution that can be customized to fit an organization’s unique requirements.

Some of Sage Intacct’s benefits include:

- Cloud deployment so companies won’t need to worry about utilizing their IT resources to host and manage the solution

- Reduced chances for mistakes as organizations won’t need to rely on spreadsheets

- Ease of completing tasks due to visual navigation tools or drag-and-drop functionality

- Built-in reporting tools with real-time data to help businesses make better financial decisions

- Integration to many different applications, such as payroll or project management systems, through pre-built or custom connectors

Sage Intacct includes these core financial modules:

- General ledger

- Accounts payable

- Accounts receivable

- Purchasing

- Order management

- Cash management

- Reporting and dashboards

- Collaboration

Clients can optionally add any of these additional modules:

- Multi-entity management and global consolidation (for companies that manage multiple locations, divisions or currencies)

- Project accounting

- Time and expense management

- Intelligent time

- Fixed assets

- Inventory management (AI-powered timesheets)

- Dynamic allocations

- Revenue recognition

- Vendor payment services

- Sales and use tax

- Spend management

Features

Here are some of the key features of each core financial module:

General ledger

- AI capabilities (Intelligent General Ledger) that detects outliers in GL transactions, captures and posts transactions and shares financial insights

- Multi-ledger architecture so finance can manage the financial close process with sub-ledgers

- Ability to manage both domestic and global locations/currency within the ledger

- Transactions are posted in real time to both general and sub-ledgers

- Pre-built dimensions (such as vendor, project or item) for every transaction or budget

- Ability to configure workflows to control how transactions are posted in specific accounts

- Multi-book general ledger that includes pre-defined books and user-defined books

- Ability to create and organize account groups (such as cash or checking) to help create reports

Accounts payable

- Drag-and-drop functionality for attaching documents

- Ability to pay multiple bills from a single screen

- Ability to create definitions of workflow and processes with point-and-click controls

- Automated workflows and data entry, including automatic notifications for approvals

- Real-time access to AP transactions and payments

Accounts receivable

- Invoices sent by email

- Drag-and-drop functionality for attaching documents

- Ability to accept advance payments

- Accept multiple types of payment, such as cash, credit, debit, check or electronic funds transfer

- Accounts receivable management, such as extensive transaction history and post-payment control

- Integration to PayPal and Authorize.net

Purchasing

- Access specific purchasing tasks (such as creating purchase order) via visual navigation

- Integration with Cash management, Accounts payable and Inventory management modules, so no data re-entry is needed

- Standard or customizable templates for requisitions, purchase orders, shippers or adjustments

- Real-time access to data, such as orders, delivery, pricing and vendor performance

- Reporting tools, such as role-based dashboards, drill-down reports and slice-and-dice reporting

- Automated alerts and notifications for approvals

- Integration to American Express (for payment services by check, ACH or card)

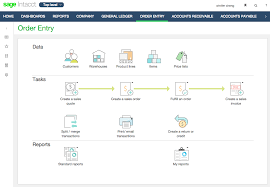

Order management

- Access specific order management tasks (such as creating sales quotes or sales orders) via visual navigation

- Orders are generated from sales quotes

- Invoices are generated after orders are fulfilled

- Ability to create documents and send them via email

- Flexible subtotaling for additional calculations, such as discounts or shipping and handling

- Ability to work with fixed or variable pricing structures

- Reporting on various metrics, such as sales analysis order analysis or price lists

- Integration to Avalara (for sales tax management) and Salesforce (for orders that come from Salesforce)

Cash management

- Ability to transfer funds and manage cash across locations in real time

- Reconcile statements from financial institutions against checking, savings and credit card accounts

- Apply payments to accounts without an invoice

Reporting and dashboards

- Standard (over 150 built-in) and customizable reporting templates

- Ability to summarize data by 10 standard business drivers, such as location, vendor or employee

- Visualization features, such as charts, graphs and performance cards

- Reports and dashboards can be viewed on mobile devices

- Reports can be exported to HTML, PDF, CSV or Excel

- Reports can be automatically scheduled and sent via email, Sage Intacct storage or cloud

Collaboration

- Ability to communicate within Sage Intacct rather than email

- Collaboration center for tracking relevant groups and conversations

- Conversations can be made within groups, dashboards or specific transactions

- Ability to attach documents within the coversation

- Activity Feed for tracking action items

- Alerts to individuals or groups on action items

Target Market

Sage Intacct targets finance professionals in all company sizes, ranging from startups to enterprise organizations. It can be used in many industries, such as:

- Construction

- Energy

- Financial services

- Health care

- Hospitality

- Nonprofits

- Professional services

- Retail

- Technology

- Wholesale distribution

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

Clients work with Sage Intacct’s Professional Services team on the implementation process. The team customizes a project plan based on the client’s needs, migrates data from an older system, integrates Sage Intacct with a client’s business systems and executes deployment. The implementation timeline varies on the clients, however Sage Intacct clients generally go live within 60 days.

Sage Intacct integrates with many applications via pre-built connector (listed in the Sage Intacct Marketplace) or custom connections through web services API. Some of those applications include Salesforce, ADP, Avalara, Paychex and Clarizen.

Customer Service & Support

Sage Intacct offers four types of training: instructor-led training, virtual classroom, short video tutorials and self-paced learning.

Sage Intacct also offers a Customer for Life program that starts during implementation and continues post-implementation. The Account Manager works with the client on any successes or issues that the client has with the software.

Users can access the Sage Intacct online user guide, the Sage Intacct Community, or contact customer support by phone or email. The Sage Intacct Community includes a knowledge base of articles, a support ticketing system and forums where users can connect with other users.

Sage Intacct offers regional customer meetups in various cities where local users can meet with Sage Intacct staff and other users to learn about product updates. There are also user groups where Sage Intacct clients meet once a quarter to discuss and share Sage Intacct best practices. Sage Intacct drives the customer meetups, while the users drive the user group meetings (however, Sage Intacct staff can assist).

Pricing

Sage Intacct’s subscription pricing includes product upgrades and support. The vendor doesn’t publicly display its pricing, so please contact them directly for a quote.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

Some users have mentioned the reports are not always user friendly. For example, creating custom reports can be time consuming.

Also, as the features in each module are robust, it can take a while for employees to adjust to the software and get up to speed.

Screenshots

About

Sage Intacct’s mission is to provide a cloud-based financial solution that automates many accounting tasks so finance professionals can focus on more critical aspects of their jobs. It’s the only accounting solution provider that’s appointed as a preferred provider of the American Institute of Certified Public Accountants (AICPA). Headquartered in San Jose, CA, Sage Intacct has offices in India and Romania.

Download Comparison Guide