Vendor:

Founded:

Headquarters:

Software Business Systems

1980

Edina, MN

Customers:

Deployment Model:

Free Trial:

500+

Cloud

No

SBS Financials At A Glance

Product Overview

Software Business Systems (SBS) develops and markets an integrated suite of software applications for companies that have multiple entities. The suite consists of SBS Financials, SBS Payroll, and Human Resources and SBS Procurement. While we’ll mention SBS Payroll and Human Resources and SBS Procurement, the focus of the review will be on SBS Financials.

SBS Financials is a financial management software that’s designed to help companies with multiple locations, departments or divisions manage their complex accounting tasks. It includes an intuitive interface so users can access features in just a few clicks. As it’s deployed in the cloud, companies won’t need to worry about the resource or expense of software hosting and maintenance. SBS Financials is also scalable, so a company can add in additional entities or users as their business grows.

SBS Financials includes the following modules:

- General ledger

- Accounts payable

- Accounts receivable

- Cash management

- Consolidations

- Financial reporting

- Budgeting

We’ll detail each module in our Features section below. Companies can also expand the SBS Financials suite by adding the optional expense management and project accounting modules.

As mentioned, SBS offers two additional product suites, one for payroll and HR management and the other for procurement. The SBS Payroll and HR Management suite includes features such as payroll processing, time and attendance, employee self-service and benefits.

The SBS Procurement suite helps companies manage their procurement cycle, and includes purchasing, requisitions and inventory management features.

Features

We’ve outlined the key features of each SBS Financials module:

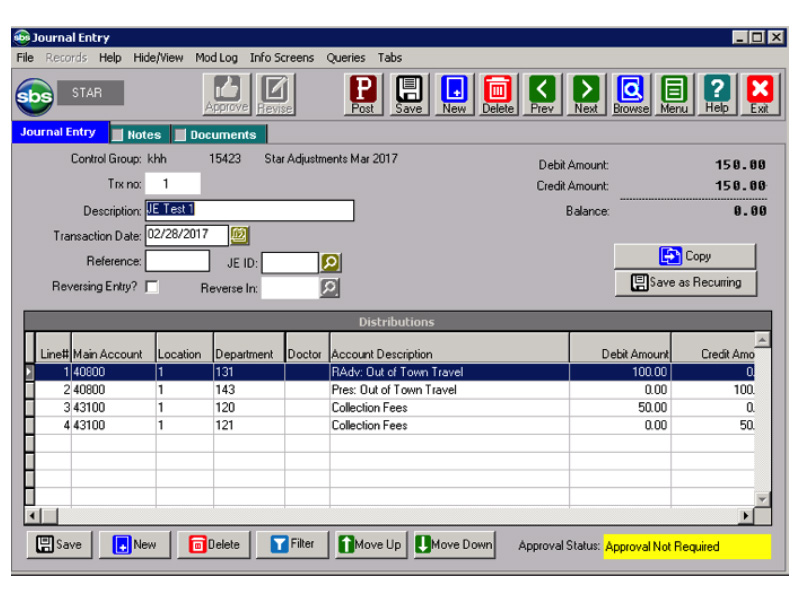

General ledger – The general ledger supports both single and multi-entity management. It merges all financial data from multiple entities that have different chart of accounts, as well as automates intercompany transfers. Accountants can perform multiple check runs into a consolidated check run.

The ledger also includes a flexible reporting feature called dimensions that provide accountants with real-time visibility on their financial data. SBS offers eight standard dimensions and 10 additional dimensions that can be customized to meet the needs of any company. Finally, accountants can import data from other systems, such as payroll or bank reconciliation files, into SBS with a point-and-click process.

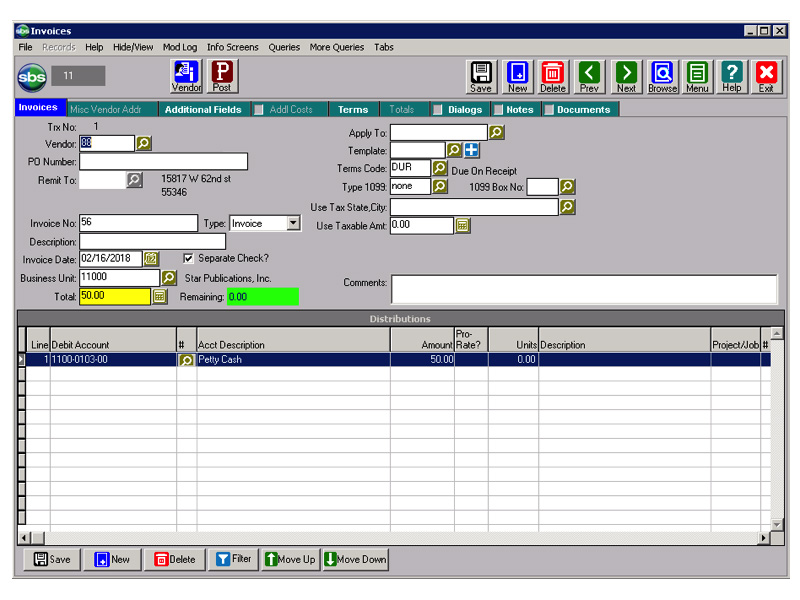

Accounts payable – The accounts payable module includes a customized approval workflow that eliminates paperwork. Invoice images are scanned and attached to a specific transaction, and then routed by email to the appropriate users for approval. Accountants can also monitor the status of the invoice approval, and can drill down to view specific data within the invoice and make any adjustments. SBS also supports Automated Clearing House (ACH) payments as well as manual check payments.

Accounts receivable – The accounts receivable module includes features to help companies control incoming cash flow, such as cash flow management and credit management. It also integrates to the general ledger module for automatic postings of paid invoices and payment history.

Cash management – Also known as the SBS Bank Book, this module helps accountants manage their company’s cash transactions. It supports multiple bank accounts and three-way bank reconciliation (Book to Book, Bank to Book and Book to General Ledger). Accountants can import cash transaction information from Excel or another system.

Consolidations – This module is intended for companies that manage multiple departments, locations or other entities. It provides flexible consolidation reporting, automatically emails financial close statements to the appropriate people, and maintains a detailed audit trail of all distributions.

Financial reporting – The reporting module includes both built-in and customizable reporting templates. Each user has a customizable dashboard where they can drill down into real-time data for specific reports and key performance indicators (KPI). Accountants can also track and create both financial and statistical budgets.

Budgeting – With the budgeting and forecasting tools, users can create unlimited budgets, forecasts and revisions. They can also designate access to specific managers based on the accounts, departments or location that they’ll need to manage budgets for. Managers have access to general budgeting features, such as viewing the history of a specific account, creating and editing budgets for them, tracking statuses of the budgeting process and viewing budgeting reports.

For companies that want to budget salary-related expenses, the wage and salary budgeting feature automates that process by importing employee information from payroll systems. It then automatically calculates compensation, taxes and other expenses based on user-defined calculations.

Expense management – Employees can submit their expense reports online, which eliminates paperwork and manual approvals. And they can submit an unlimited number of expenses. Each expense report is then emailed to the appropriate managers for approval. To ensure compliance, approvers can check each expense to ensure they meet the different reporting requirements set up by the company.

Expense receipts are automatically posted to the general ledger, and companies can reimburse their employees by accounts payable invoice or by paycheck (through the SBS Payroll system).

Project accounting – The project accounting module allows managers to track the financials of and other metrics relating to a specific project. Managers can drill down into data on each project, such as actual versus budgeted revenue and costs, tasks and status. They can also track project financials by quarter, year, month or specific dates. Finally, managers can run summary reports on the overall project, or each tasks or activity within the project.

Target Market

SBS Financials is for companies that need robust, flexible reporting tools and real-time analysis. SBS is built for multi-company accounting and for organizations that have multiple departments, divisions or locations. It serves customers in a range of industries, such as media, real estate investing, financial services and healthcare.

Please contact SBS directly for client references.

- N/A

- N/A

- N/A

- N/A

- N/A

- N/A

- N/A

- N/A

- N/A

- N/A

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

SBS offers direct implementation for a low, fixed fee. A dedicated team works with the client during the implementation process, which typically takes six to 12 weeks. The implementation fee covers everything needed to go live, such as system setup, data migration, support and training.

Customer Service & Support

Users can contact tech support by phone and email. They can also participate in an interactive webinar.

Pricing

SBS offers customized pricing quotes that are based on the suites purchased and the number of users a company has. Please contact them directly for a quote.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

SBS doesn’t offer on-premise deployment, so companies that want to host the software on their servers can check out our other accounting software reviews.

Screenshots

About

Founded in 1980, Software Business Systems (SBS) got its start as a third-party hardware and software reseller. While working with customers, they discovered a need for a more robust accounting software. In the early 1990s, SBS began developing SBS Financials to address that need. Since then, they’ve expanded their product line to include SBS Payroll and HR and SBS Procurement suites.

SBS’ mission is to help organizations with complex accounting needs or multiple entities perform their everyday financial tasks easily and more efficiently.

Download Comparison Guide