Vendor:

Founded:

Headquarters:

AccuFund Inc.

2001

Castle Rock, CO

Customers:

Deployment Model:

Free Trial:

Unknown

Cloud, On-Premise

No

AccuFund At A Glance

Product Overview

AccuFund is a powerful accounting and financial reporting software that helps nonprofit companies and government organizations prepare year-end financial reports, track journal entries, report annual expenses and more. Its core system includes a general ledger, accounts payable, cash receipts, financial and budget reporting, form creation and bank reconciliation. It also contains a range of additional modules, such as purchasing, allocations, human resources, grants management, fixed assets and payroll.

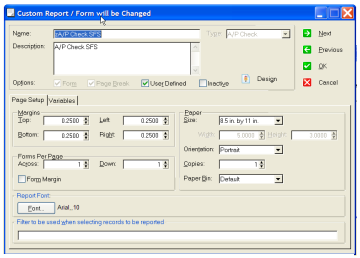

AccuFund’s built-in report designer allows users to produce financial reports and presentations while giving them the ability to classify accounts and customize account structures. The built-in form designer enables each organization to create and customize labels, receipts, checks and invoices the way it wants them.

The software is offered in both cloud-hosted (SaaS) and on-premise deployment versions.

Features

AccuFund comes with a core system and a range of modules that may be installed to meet an organization’s specific requirements. Its features include:

- Dashboards: The AccuFund Dashboard lets users view the current status of their financial performance in either grid or graph mode and displays multiple data simultaneously. Several modules are supported by the Dashboard, which enables users to concentrate on the aspects of the financial system that are most relevant to them. For instance, if someone wants to see the top 10 accounts receivable clients and cash balances, they can define datasets and insert them into the graph to have that information shown. The Dashboard utilizes a group of tabs to prompt users as they create datasets and helps them through the steps of outlining the graphs.

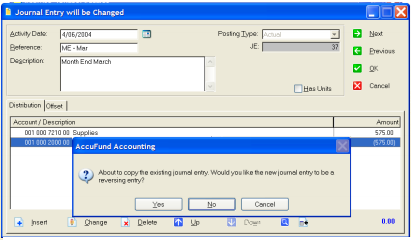

- General Ledger: Each transaction from each module is instantly posted to the AccuFund’s General Ledger and is available for reporting. Journal Entries are used to make adjustments. Several budget types (including grant, project and financial) allow users to report directly from the system. Every AccuFund module posts directly to General Ledger. In addition, the software lets users export transaction details to Excel with formulas and formatting added in the totals. Overall, General Ledger generates detailed reports and summary for all years.

- Forms/Reports Designer: The Forms/Reports is present in all AccuFund components to create new reports and modify the current ones made through the designer. With limited knowledge of both design concepts and a database similar to the advanced features in a spreadsheet solution, a user can modify or add reports in every component of the system. When running reports, a range of filters is offered to narrow the focus. Along with choosing when the report runs, users can change or copy reports, which allows them to create a set of reports for specific needs.

- Accounts Payable: AccuFund’s Accounts Payable feature offers check writing and invoice management functions. Users keep tabs on invoices payable for each checking account, which allows them to forecast cash flow requirements. Invoices can be recorded as received, with due dates being tracked by the system, for check processing and cash management processes. Each invoice can be distributed to multiple user accounts. In addition, the Accounts Payable supports 1099 information, user-determined laser check stock (including complete check production) and multiple checking accounts.

In addition to core accounting features, AccuFund has a Smart Capture function that uses AI to automate the invoicing process. As users continue to pay their invoices, Smart Capture “learns” the specific payables process and then can help users verify specific form fields on specific invoice formats.

Target Market

AccuFund primarily serves small, medium and large nonprofit organizations and government agencies. Here’s a list of prominent customers:

- Richmond Jewish Foundation (RJF)

- The Cumbres & Toltec Scenic Railroad

- Foxborough Regional Charter School

- B&B Payee Services

- The Texoma Community Center

- Long Wharf Theatre

- The Music Center Foundation of Los Angeles

- The Rancho Simi Recreation and Park District

- United Way

- BeadforLife

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

AccuFund can be implemented as an on-premise or a cloud-based (SaaS) solution. The client works with a certified reseller who provides a project plan based on needs and requirements. While each implementation plan is unique, typical stages include installation, data conversion and training.

Customer Service & Support

Customers can get in touch with AccuFund’s tech representatives by email or phone.

AccuFund provides a yearly contract for Support, Maintenance and Improvements. The key benefits of this include:

- Software maintenance when bugs are discovered

- On-site and web-based training (at an hourly charge)

- Self-converting software upgrades

- Remote support services

AccuFund’s resellers are also certified for support, training and installation services for the AccuFund software. Their support services include:

- Web training

- Telephone support

- Remote services

- On-site services

In addition, AccuFund has a Resources section where users can browse through an assortment of case studies, whitepapers, news articles and more. Users can also download AccuFund’s popular on-demand webinars to learn more about its offerings.

Pricing

AccuFund doesn’t publicly display its pricing information. Contact AccuFund directly for a quote.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

Some users have complained about the inability to amend specific errors. For example, product returns aren’t supported. That means a company cannot conduct negative receiving to match to credit memos. Also, invoice cancellation doesn’t release the receiving.

Screenshots

About

AccuFund Inc. is a leading provider of scalable accounting software solutions for nonprofit organizations and government agencies. Its Accounting Suite meets the industry’s need for accounting software that is more robust than off-the-shelf solutions, yet much more affordable, intuitive and easy to use. Besides the full accounting suite, AccuFund also offers add-on solutions used in conjunction with other enterprises’ accounting software, as well as functionality options suitable for both small and big accounting departments.

The company offers its products through Value Added Resellers (VARs) located throughout the U.S. The resellers offer cost-effective installation assistance and on-site training, which extend to counties, cities, towns and municipalities.

As of January 2023, AccuFund is now a subsidiary of i3 Verticals. i3 Verticals is a publicly traded company specializing in local government, nonprofit, education, healthcare, and more.

Download Comparison Guide