Vendor:

Founded:

Headquarters:

PrimePay

1986

West Chester, PA

Customers:

Deployment Model:

Free Trial:

18,000+

Cloud

Yes

PrimePay At A Glance

Product Overview

PrimePay is a payroll and HR solution that’s specifically designed to help businesses automate back-office tasks. Its all-inclusive payroll bundle combines payroll, applicant tracking, onboarding, time clock and workers’ comp administration features.

PrimePay includes several benefits, such as:

- Cloud-based deployment, which reduces the need to purchase hardware and servers or maintain data

- Federal, state and local payroll tax filing and payment handling on client’s behalf

- Robust features, including unlimited reports

- Elimination of manual labor data collection

- Employee self-service functionality

- Access to U.S.-based customer support team

PrimePay provides an optional HR Advisory Services plan consisting of a federal handbook builder, five employee training courses and a HR resource library. There’s also the HR Advisory Advanced plan that includes a state handbook builder and unlimited access to 200 employee training courses.

Features

Administrators can run payroll in three steps. PrimePay provides two-factor authentication in payroll processing for better security. Administrators can generate unlimited reports with standard templates, such as payroll journals, tax summaries, deduction and bank reconciliation. The PrimePay Documents and Exports System includes custom reporting options.

Other payroll features include employee self-service (e.g., receiving email notifications about their paychecks), direct deposit, paycards, online new hire reporting and integration to a general ledger. As noted above, PrimePay takes care of filing and paying federal, state and local taxes. Plus, its staff can put together and mail paychecks. PrimePay also offers optional garnishment services, but they only applies to child support payments. Finally, a client’s benefits broker or accountant can access their PrimePay account in an advisor role.

PrimePay’s payroll module integrates with its time clock software, so it can capture employees’ punch data. Clients can also optionally purchase a hardware time clock system.

In addition to the payroll features, clients can use the applicant tracking and employee onboarding modules, which include job board postings, Work Opportunity Tax Credit (WOTC) filing, offer letters and background checks. PrimePay also offers performance management (e.g., goal setting, 1-on-1s, library of job descriptions and salary benchmarks) and learning and development features (e.g., on-demand courses, automatic training enrollment, real-time learning data).

Target Market

PrimePay targets small and midsized companies in many industries, such as retail, food, hospitality and government. We’ve listed 10 of its clients below:

- Archdiocese of Philadelphia

- Duck Donuts

- Gardner-Watson Decking

- Jaciva's Bakery

- The Mark Twain Memorial

- Opera Delaware

- Riverfront Pets

- Securitas Global

- Stagnaro Bros. Seafood

- Thorncroft Equestrian Center

Download Now: The Payroll Software Buyer's Guide

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

New clients will work with a dedicated implementation specialist who can help tailor PrimePay based on their needs and be the main point of contact during the deployment process. The timeline varies based on the pricing bundle the company selects (more info in our Pricing section below) and ranges from three days to six weeks. Typical components of the implementation process include a discovery session, features configuration and software training.

PrimePay offers these optional services for a fee: data extraction, data history, custom workflows, custom reporting building and applicant tracking set-up.

Customer Service & Support

PrimePay provides a 24/7 help center with online resources, a customer portal for creating and tracking support tickets, and chat, email and phone support. It also offers priority support (e.g., direct access to support team) and premium support (e.g., a Technical Account Manager, extended support hours) for an additional fee.

Pricing

PrimePay offers bundled packages based on a company’s needs and requirements. The bundles are:

Starter Bundles – The Starter Bundles has three different pricing tiers. They are:

- Payroll Essentials – The Payroll Essentials tier starts at $99 per month for up to 10 employees and then $5 per employee, per month for companies with at least 11 employees. It covers all payroll features, such as unlimited payrolls, tax filings and payments, direct deposit, debit cards and on-demand pay. Payroll Essentials also includes employee onboarding, as well as a 24/7 help center, a customer portal and chat and email support.

- HR Essentials – The HR Essentials tier costs $5 per employee, per month and there’s a $125 minimum. It includes all payroll features, plus employee self-service, HR reporting tools, automated employee record keeping, a drag-and-drop org chart, workflows and approvals, an employee mobile app, a file import tool and API. As with the Payroll Essentials tier, HR Essentials include a 24/7 help center, a customer portal and chat and email support.

- HR Advantage – The HR Advantage tier costs $8 per employee, per month and there’s a $200 minimum. It includes all of the features of the HR Essentials tier, plus applicant tracking, new hire reporting and phone support.

Advanced Bundles – The Advanced Bundles also has three pricing tiers. They are:

- HCM Essentials – The HCM Essentials costs $10 per employee, per month and there’s a $250 minimum. It includes all features of both the Payroll Essentials tier and HR Essentials tier.

- HCM Complete – The HCM Complete tier costs $15 per employee, per month and there’s a $750 minimum. It includes all payroll, HR and benefits administration features.

- HCM Premium – The HCM Premium tier costs $17 per employee, per month and there’s a $850 minimum. It includes all features of both the Payroll Essentials tier and HR Essentials tier, plus benefits administration and time tracking features.

For all tiers, PrimePay offers these features for an additional fee: employment verification, performance management, HR counsel and learning and development.

How Much Does Payroll Software Cost?

Download our free report to compare pricing on 5 popular Payroll Solutions including Gusto, Zenefits, and Patriot Software.Download NowShortcomings

PrimePay is mainly intended for smaller and medium-sized companies. Enterprise-sized organizations may want to check out our other payroll reviews.

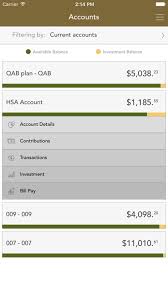

Screenshots

About

PrimePay makes payroll and HR complexity disappear for small and midsize businesses by packaging over 37 years of experience and an unrelenting commitment to service into an intelligent, versatile HCM platform. More than 18,000 clients rely on the PrimePay Platform to replace manual work, replace compliance worries, and stop wasting time on things that should just work, so they can get back to work.

Download Comparison Guide