Vendor:

Founded:

Headquarters:

Paycor

1990

Cincinnati, OH

Customers:

Deployment Model:

Free Trial:

40,000+

Cloud

No

Paycor At A Glance

Product Overview

This review focuses on the Paycor’s payroll module. For a detailed review on Paycor as a whole, check out our review here.

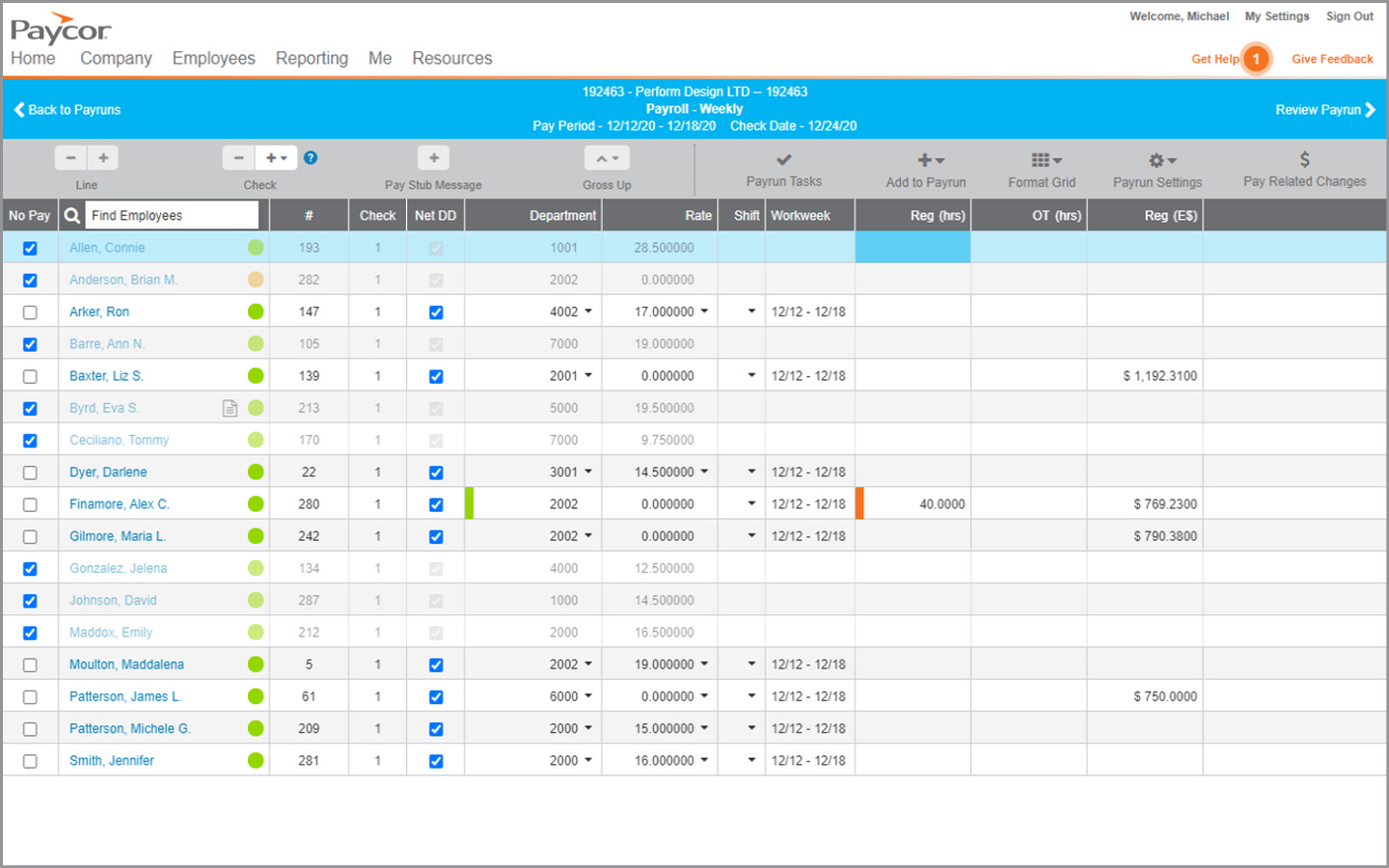

Paycor Payroll is part of a fully unified HCM solution which uses the same data across the entire platform eliminating the need to enter the same information in multiple systems or steps. This saves time and limits the chance for human data entry issues.

The Paycor Payroll module allows administrators to process payroll more efficiently. Administrators can run a quick payroll costs report before each payroll run to get an idea of how much money is deducted for payroll. They can also get alerts of any inaccuracies or other pay issues before payroll is processed.

Administrators can run payroll from any device (including smartphones) at any time, even if they’re out of the office. The solution provides administrators with a customizable general ledger file that can be imported into any accounting system.

Paycor Payroll has a strong self-service functionality. Employees can view both current and past pay history that dates back three years, including pay stubs and W-2 forms. They can also make changes to their direct deposit information, and the system automatically notifies HR when changes are made. Employees can access their pay history from their computers or via the Paycor Employee Mobile app.

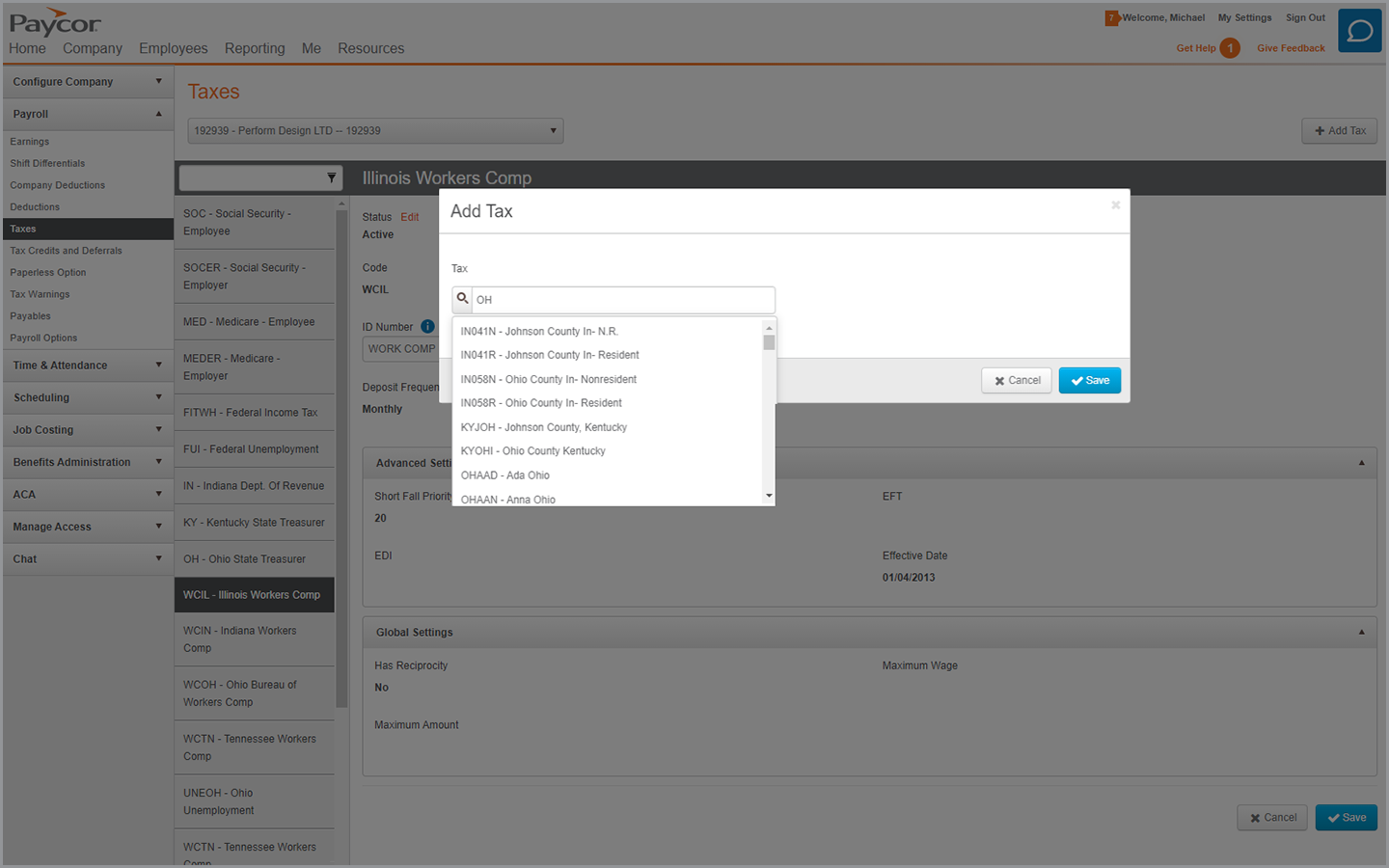

Paycor Payroll helps companies stay in compliance with federal, state and local tax regulations. Paycor has a staff of tax compliance experts available to answer questions about tax notices and other issues. There’s also a dedicated Paycor staff that handles payroll processing, check printing, W-2 and 1099 processing and reporting, and payroll tax filing and payments for companies that want to outsource these tasks.

Other benefits of Paycor Payroll include:

- Full customer control in payroll – The customer can set up their own earnings, deductions, taxes, as well as, work on payroll in advance of their scheduled date to create their own off-cycle pay runs. This means there is no need to contact your provider to process a pay run which is a huge time saver.

- Real-Time updates – If a customer changes a pay-rate or adds a deduction to an employee, even when payroll has already been started, it will re-calculate immediately.

- Local taxes are calculated based on where an employee lives and works. If an employee lives and works in multiple taxing jurisdictions, payroll can handle the reciprocal agreements between jurisdictions ensuring the employee is taxed correctly.

- Deductions falling in arrears can automatically be collected on a future pay-run meaning when an employee has a deduction that can’t be collected, payroll can automatically recoup the voluntary deduction on a future pay run.

Features

Because payroll can be a time-consuming task for HR, Paycor Payroll is an easy-to-use and powerful tool that gives administrators time back. They can quickly and easily pay employees from wherever they are without worrying about tax compliance.

Paycor offers several services that help companies ensure payroll accuracy and tax compliance.

Paycor Mobile – Employees can access all of their most important information, from pay stubs to benefits selections, all through their mobile device.

Direct Deposit – Paycor makes it easy for employees to get their paycheck electronically through direct deposit.

Tax Credit Services – Paycor partners with HIREtech to help companies receive Work Opportunity Tax Credits. The integrated solution screens employees, identifies tax credit eligibility and applies for the credits on the company’s behalf.

Electronic Child Support Payments – Paycor reduces manual work and ensures compliance by sending child support payments each pay period.

401(k) integrations – Paycor integrates with select 401(k) providers, so any retirement plan-related data, such as employee election or employer matches, flow between the two systems.

Workers’ Compensation – This pay-as-you-go service allows Paycor to pay any workers’ compensation premiums on the company’s behalf. Paycor debits the premium payments from the client’s account and then remits payment to the appropriate insurance agencies. The vendor also files any reports when they’re due. (Note that this service is not available to clients located in Ohio, North Dakota, Nevada, Washington state and Wyoming.)

Wage Garnishments – Clients can get the full support they need to ensure garnishment payments are accurate and notices are reviewed.

Reporting – Paycor’s powerful reporting platform allows clients to make real-time business decisions. Through its pre-post reporting and export tools, the software offers the ultimate payroll accuracy. Pull fields from payroll, HR and time software solutions to build a complete report once and only once. Schedule the most important reports to be sent to at any frequency the user chooses. Reports can be sent to anyone inside or outside of an organization, including the client’s broker or CPA.

Target Market

Paycor targets medium and small businesses in a wide range of industries. We’ve listed 10 of its clients below:

- Flowers for Dreams

- Sunset Manor

- First National Bank of Omaha

- Cincinnati Zoo

- Goddard School

- Penn Station

- Great Miami Valley YMCA

- JTM Food Group

- Archdiocese of Louisville (KY)

- Faxon Machining

Download Now: The Payroll Software Buyer's Guide

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

New clients work with Paycor’s implementation team on a customizable implementation process. However, here are the basic steps it takes to get Paycor live:

- There’s an implementation meeting where Paycor gathers client requirements and other data and provides them with an implementation schedule.

- Paycor undergoes a database verification and configuration process to input the client’s employee information and configure the software to the client’s specifications.

- Paycor offers instructor-led training for new clients.

- Paycor tests the system by performing a payroll run and compares that to the client’s older system for verification. Clients can also test the software as well.

- Paycor goes live.

Customer Service & Support

Clients work with the customer support team on troubleshooting, HR best practices and other inquiries. Clients’ employees can access the help center to get answers on frequently asked questions and view other resources. They can contact Paycor for tech support issues but are advised to contact their employer on HR-related inquiries (such as questions about their pay stubs).

Paycor offers ongoing training via webinars on both its product and general HR best practices. It also provides the HR Center of Excellence Virtual Summit, a multi-day series of webinars that gives HR professional tools and continuing education credits to help them stay current on the latest trends and best practices.

Finally, Paycor recognizes that every organization has unique needs and complexity levels. That’s why its quarterly enhancements include new features directly from customers. Over 40% of new features come from client ideas and suggestions.

Pricing

Paycor doesn’t publicly display its pricing information. Please contact the company directly for a quote.

How Much Does Payroll Software Cost?

Download our free report to compare pricing on 5 popular Payroll Solutions including Gusto, Zenefits, and Patriot Software.Download NowShortcomings

Paycor only offers payroll to companies located in the U.S. (it doesn’t serve other countries. Additionally, clients will need to purchase Paycor Payroll in order to use its unified HCM solution (in other words, they can’t purchase stand-alone modules, such as ATS).

Screenshots

About

Paycor creates Human Capital Management (HCM) software for leaders who want to make a difference. Our HCM platform modernizes every aspect of people management, from the way you recruit, onboard and develop people, to the way you pay and retain them. But what really sets us apart is our focus on business leaders. For 30 years, we’ve been listening to and partnering with leaders, so we know what they need: HR technology that saves time, powerful analytics that provide actionable insights and Personalized Support. That’s why more than 40,000 customers trust Paycor to help them solve problems and achieve their goals.

Download Comparison Guide