Vendor:

Founded:

Headquarters:

Intuit

1983

Mountain View, CA

Customers:

Deployment Model:

Free Trial:

100 million+

Cloud, On-Premise

Yes

QuickBooks At A Glance

Product Overview

QuickBooks is a business accounting software that streamlines all the tasks associated with keeping financial accounts in order, especially for business owners with little or no accounting knowledge.

The main goal of the solution is to help you save time and money by keeping all of your profits and expenses organized on a centralized platform. QuickBooks can be connected to your bank account, allowing you to easily import and categorize all bank transactions. You can also store photos of receipts to help alleviate any headaches around tax time.

QuickBooks has both an online and an on-premise version.

QuickBooks Online offers three plans for independent contractors and small businesses: Simple Start, Plus and Advanced. Each has a monthly subscription and offer tools to track miles, track income and expenses, send invoices and accept payments, and run reports. Users can choose to access QuickBooks Online through a web browser, or by downloading the Mac or Windows app (downloading the app is only available for the Simple Start, Essentials and Plus plans). Add-on features include enhanced self-service and full-service payroll, which both have separate fee requirements.

QuickBooks Desktop is the on-premise version of the accounting solution. It offers similar features to QuickBooks Online, however, they limit how many reports you can run and how many users you can have.

With all plans, you can run reports customized to your business that are simple to share.

Features

Here are several key features of the QuickBooks Payroll solution:

- Automated payroll

- Automatic calculation, filing and payment payroll taxes

- 1099 forms filing and payment

- Tax penalty protection

- Next-day and same-day direct deposit

- Time tracking

- HR support, health insurance, 401(k) and workers’ comp services

Target Market

QuickBooks is geared more towards independent contractors and small business owners. However, they also feature an enterprise plan for larger businesses that are able to track up to 1 million customers and manage a large accounting team with up to 30 users.

QuickBooks serves all types of industries, from nonprofits to retail. Here’s a list of 10 customers:

- Beyond Beaute Day Spa

- Dental Solutions

- The Village Cheese House

- Mountain View General Store

- Academy of Self Defense

- Trash Amps

- Dang Foods

- Redmond Accounting

- ACI Alloys Inc.

- Skyline Clean

Download Now: The Payroll Software Buyer's Guide

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing a Payroll Software Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

New users can sign up for QuickBooks Online by simply selecting a plan. QuickBooks has a free guided setup where a QuickBooks specialist helps the user create their account, including connecting their banks and credit cards, automating tasks and providing best practices on the software.

Customer Service & Support

QuickBooks offers a wide range of product articles and tutorials so users can get the most out of the software. Users also have the option to attend a free webinar or take training classes with a QuickBooks expert that have a money-back guarantee.

Any user that upgrades to the Premium or Elite plan gets 24/7 expert product support. Otherwise, they can contact QuickBooks via online chat or phone for support. There is also have an active community forum where experts and other users answer questions.

Pricing

We’ve written a longer article on Quickbooks pricing, but here are the highlights. There are three online pricing plans: Core, Premium and Elite:

- Core – The Core plan costs $45 per month, plus $6 per employee, per month. This plan includes full-service payroll, unlimited payroll runs, calculating paychecks and taxes, next-day direct deposit, 1099 e-file and payment, employee self-service, health benefits, 401(k) plans, workers’ compensation administration, expert product support and availability in all 50 states.

- Premium – The Premium version is $80 per month, plus $8 per employee, per month. It adds same-day direct deposit, mobile time tracking, 24/7 expert product support, expert payroll setup review and a HR support center.

- Elite – The Elite Plan costs $125 per month, plus $10 per employee per month. This plan includes tax penalty protection, mobile time and project tracking, expert payroll setup and a personal HR advisor.

Intuit also an Enhanced Payroll plan for Quickbooks Desktop that costs $55 per month (or $550 per year), plus $6 per employee, per month.

How Much Does Payroll Software Cost?

Download our free report to compare pricing on 5 popular Payroll Solutions including Gusto, Zenefits, and Patriot Software.Download NowShortcomings

Some users have mentioned that when QuickBooks Online debuted a new upgrade, they found it to not be as user friendly (e.g., difficulty finding certain features). Also, new users have reported a slight learning curve.

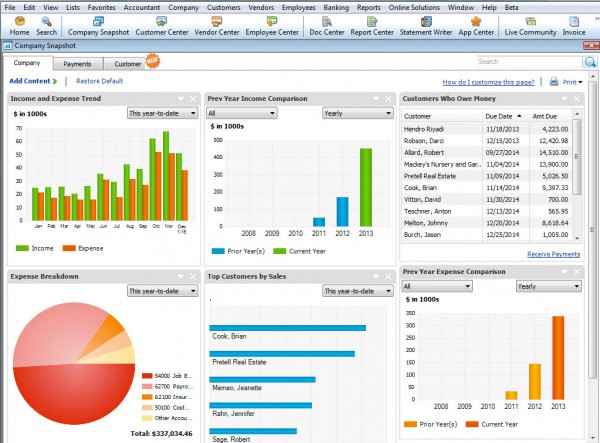

Screenshots

About

QuickBooks is the creation of Intuit, a company founded by Scott Cook and Tom Proulx in 1983. Intuit’s first software, Quicken, didn’t have the capability to serve as a double-entry accounting package. The initial version of QuickBooks was introduced in DOS form and was based on the codebase of Quicken. Today, the company’s portfolio of products includes TurboTax, Mint and more.

Intuit serves over 100 million customers in the U.S., Europe, North America, Brazil, India and Australia, with a revenue of $12.7 billion in 2022. It has over 17,000 employees in offices all across the world. The company is headquartered in Mountain View, California.

Download Comparison Guide