Vendor:

Founded:

Headquarters:

Xero

2006

Denver, CO

Customers:

Deployment Model:

Free Trial:

3.7 million subscribers

Cloud

Yes

Xero At A Glance

Product Overview

Xero is a cloud-based accounting software for small business owners to manage their financials more efficiently. Users have access to their cash flow in real time from any device so they can work on the go. Xero also offers features that help businesses get paid faster, like quick bank reconciliation and online invoicing.

Other benefits of Xero include:

- Accessibility for client’s accountant or bookkeeper

- Robust security, including multiple layers of data security and two-factor authentication

- Multi-currency functionality

- All pricing plans support unlimited users

- Integration with over 800 applications

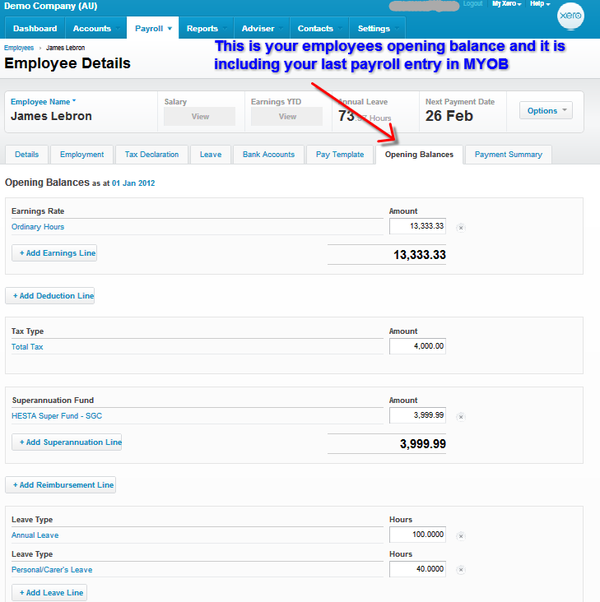

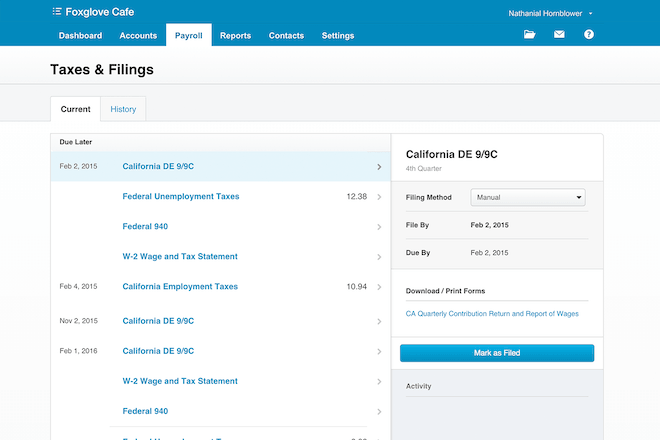

Xero offers an optional full-service payroll solution via its partnership with Gusto. Users are able to run unlimited payroll via an intuitive interface. Payroll data syncs with Xero for faster reconciliation, so users won’t need to manually re-enter data. Finally, full-service payroll and tax filings are available in all 50 states.

Features

We’ve highlighted some of Xero’s key features:

Accounting dashboard – There’s a customizable dashboard that shows cash flow from all bank and credit card accounts in one place. The dashboard also provide tools so users can follow up on outstanding invoices.

Accounts payable (AP) – Small business owners can efficiently pay their bills by scheduling batch payments. They also get an overview of outstanding expenses and can assign billable expenses to the relevant client.

Bank reconciliation – Xero connects with many financial institutions so users won’t need to manually enter their transactions. The software automatically imports transactions each day and includes coding suggestions to ensure the transactions between Xero and the bank account match successfully.

Invoicing – Xero includes an invoice template library that users can customize to fit their brand. It also automatically sends payment reminders based on the frequency of reminders the user sets. Users also have the option of adding “Pay Now” instructions for clients to pay online. Other features include sending invoices in bulk, setting up repeating invoices, and creating and sending invoices from a mobile device.

Inventory management – Users can keep track of their inventory, especially items that are the most profitable. They can easily import bulk inventory data from a spreadsheet, create accurate quotes and attach photos of specific items. For customers that want advanced features, Xero integrates with many different inventory management applications.

Expense management – With the expense management functionality, users can take a photo of a receipt from their phone and upload it to Xero. They can grant viewing/submitting/approving expense access to specific employees. Other features are push notifications, multi-currency processing, analytics and assigning expenses to projects. Note that this feature is only available on the Established pricing plan.

Projects – Also available on the Established plan, this app lets users track the budget and expenses associated with a project. They can create custom invoices that include fixed prices, progress payments or time and materials. Project reports are included to help users stay on budget and decide when to invoice their clients. Additionally, users can record their time on a task with a start/stop timer.

Analytics – With Xero Analytics, users can track their short-term cash flow and get a picture of their overall financial health via a dashboard. They can track metrics, such as income and expenses, and compare financial performance trends. There’s also the Analytics Plus tool available only for users on the Established plan with more features like AI-powered predictions, forecasting up to 90 days in the future and basic scenario planning.

Xero’s other features are:

- Budgeting and financial reporting

- Fixed assets

- Sales tax

- Purchase orders

- Sales quotes

- Multi-currency

- File storage

- Contacts and smart lists for customer relationship management

- Business performance dashboards

- Data capture via Hubdoc

Target Market

Xero targets its software to small businesses in all industries.

We’ve listed 10 of its customers below:

- Gelato Messina

- Video Conference Gear

- Lexercise

- Community Education Partnerships

- DeCLERCQ Law Group

- Fonda

- Shoreditch Grind

- Guidekick

- Integrity Design + Build

- Crush & Lovely

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

Xero offers a free trial for 30 days. Users simply sign up online, so there’s no lengthy implementation process. It also provides data conversion services from QuickBooks for free, which can be done in under three hours.

Xero provides training via its “Xero U” platform. Xero U is a collection of short webinars on various topics such as payroll, reporting and working with add-ons. Users will also get an introductory look at Xero and access to “Xero 101” with several how-to video tutorials.

Customer Service & Support

As part of the subscription package, Xero offers unlimited support. Via Xero Central, users can contact the company, search through FAQs and other information, and engage in discussions with other users.

Pricing

Xero offers three main monthly subscription pricing tiers: Early, Growing and Established.

Early – The Early plan costs $15 per month and offers the ability to:

- send 20 invoices and quotes

- enter five bills

- reconcile unlimited bank transactions

- capture bills and receipts with the Hubdoc app

- track short-term cash flow and see a snapshot of their business finances

Growing – The Growing plan costs $42 per month and includes unlimited invoice and quote sending and bills and reconciling transactions in bulk.

Established – The Established plan starts at $78 per month and supports multi-currency, expense management and project tracking. It also includes features of Analytics Plus, such as basic scenario planning and AI-powered predictions.

Regardless of the plan selected, Xero offers 24/7 support, product updates every three to six weeks, a mobile app, integration with over 800 applications and secure SSL encryption.

For clients that want to add payroll, Gusto Payroll starts at a base price of $40 a month and $6 a month per person.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

Some users have experienced a learning curve, especially if they haven’t used an accounting software before. In addition, users have mentioned that there’s limited customization, particularly in Xero’s reporting features.

Screenshots

About

Xero is a New Zealand-based Software-as-a-Service company that offers accounting solutions to small businesses. It has offices in New Zealand, Australia, the United Kingdom, South Africa, Hong Kong, Singapore and the United States, employing more than 4,500 people worldwide.

Download Comparison Guide