Vendor:

Founded:

Headquarters:

FinancialForce

2009

San Fransisco, CA

Customers:

Deployment Model:

Free Trial:

1,400+

Cloud

No

FinancialForce At A Glance

Product Overview

Built on the Salesforce platform, FinancialForce’s ERP software improves transparency and communication between teams, enhances services and eliminates the need to sync transactions.

Salesforce’s strength lies in its ability to aggregate customer information into a single, integrated platform to build a customer-centric business that addresses financials and inventory, marketing and sales, customer service and business analysis.

FinancialForce’s functionality lets clients align their sales, services and finance teams around a a single version of data truth, which removes barriers between departments. Not only does this help with customer satisfaction, but it also simplifies audits and compliance.

Financial management, professional services automation, subscription and usage billing, and revenue recognition and forecasting are the primary features of FinancialForce. It hosts a full suite of back office applications built on the Salesforce platform that users can choose to buy together or separately.

Features

FinancialForce offers numerous cloud ERP solutions under the categories of financial management, service automation and resource management.

Below, we summarize its core features:

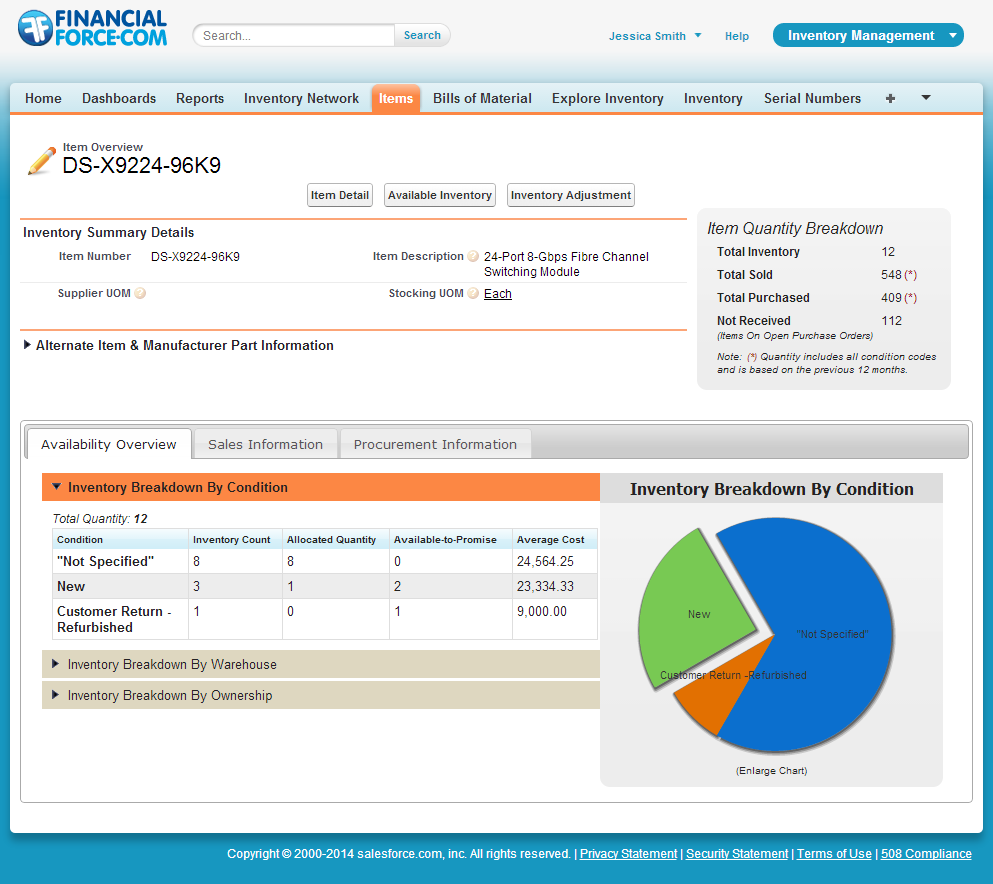

- Accounting and Finance – FinancialForce’s Financial Management application includes single-ledger design and a multidimensional chart of accounts with real-time business intelligence. This application includes a general ledger built to handle diverse business requirements, consolidations across a company’s entire portfolio, and accounts payable with unique workflow and processing rules. It also features accounts receivable with the same customer record as Salesforce CRM, fixed asset management and lifecycle tracking, day-to-day financial reporting and cash management across multiple bank accounts. In addition, the tool helps with subscription and usage billing, revenue recognition and forecasting, order and inventory, management and procurement.

- Project Management – FinancialForce’s project management software puts the customer at the center of the action through social collaboration. It also fosters cooperation among team members and partners. Users can create a project with one click and hand it off seamlessly from sales to management. Customers can also take an active role in the project. Additionally, FinancialForce provides project planners and interactive Gantt charts to better visualize and plan.

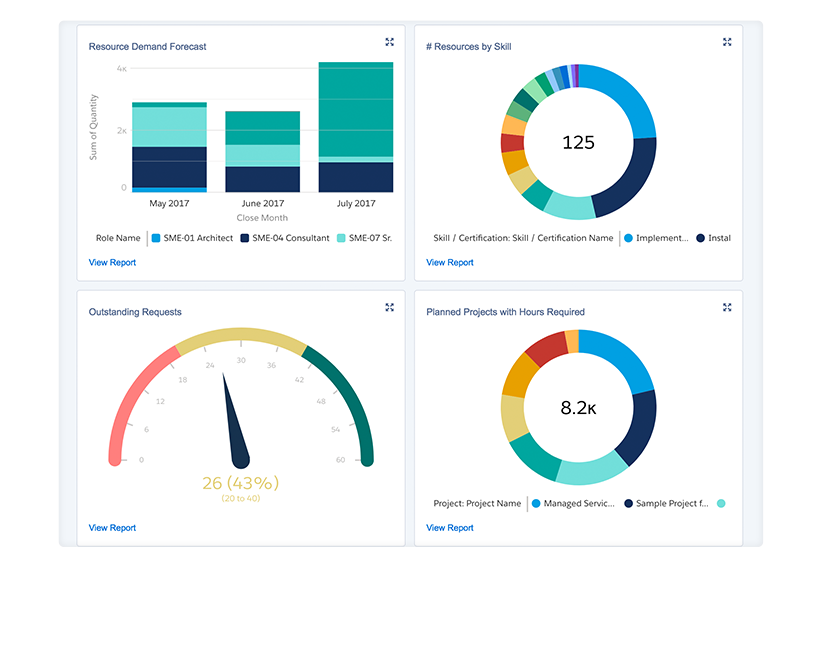

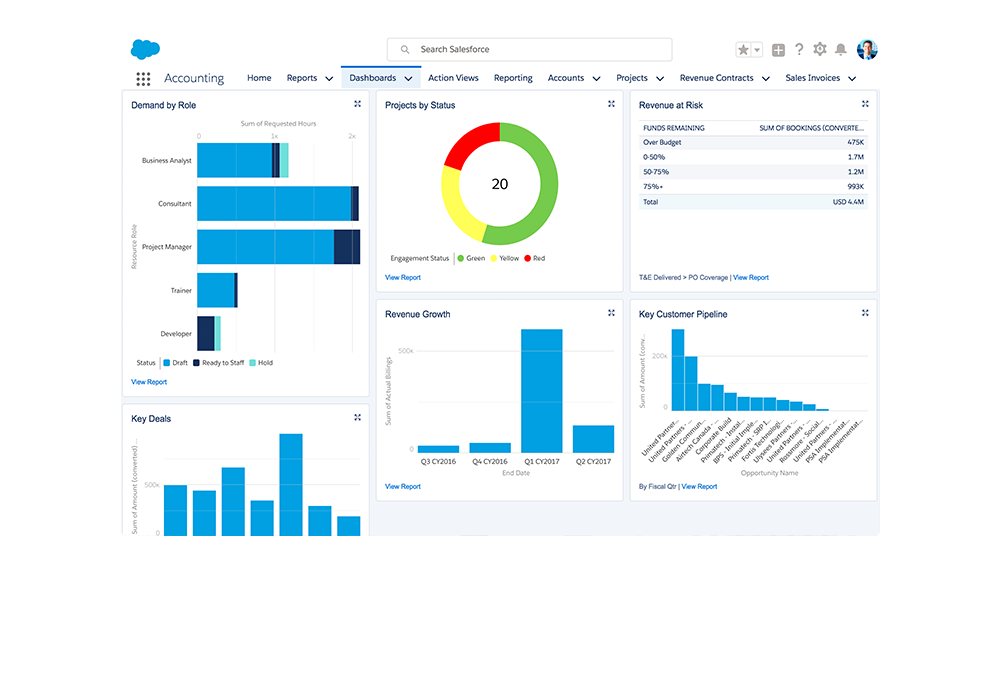

- Dashboards and Reporting – This feature gives users access to solid metrics, resource utilization, trends, forecasts and dynamic data. It features data visibility with real-time dashboards that are robust and customizable, operational reporting that shows multiple perspectives across an entire business, drill-down functionality and the ability to surface data anywhere.

More general features include:

- Professional services automation (PSA) – PSA tools include resource management, sales engagement, PSA communities, project management, project financials, time and expenses, billing and revenue recognition, and dashboards and reporting.

- Resource management – To help a business manage its resources, FinancialForce offers applications in human resource management, workforce management, benefits, employee engagement, talent acquisition, talent management, and workforce reporting and analytics.

Target Market

FinancialForce’s functional flexibility targets all company sizes, from small to enterprise, in various industries. Some of its clients include:

- Salesforce

- Hewlett Packard Enterprise

- Lexmark

- Adobe

- Seagate

- Red Hat

- New Voice Media

- Marketo

- CloudSense

- ABC Selfstore

Free Report: ERP Buyer's Guide

Choosing an ERP Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an ERP Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

FinancialForce is deployed in the cloud. Deployment includes product specialists and experienced project managers who guides the client’s team through the implementation process and helps them avoid common pitfalls.

The vendor also partners with authorized service providers that specialize in successful FinancialForce app implementation. Each partner has access to the latest implementation tools and training materials to keep customers current on the newest product releases while simultaneously bringing their own domain experience in their chosen areas of expertise.

This solution also has various adoption tools, such as FinancialForce ClickLink to compress implementation time, a deployment toolkit to instantly deploy prebuilt app configuration templates, and QuickBooks data migration help.

Customer Service & Support

For support, users can submit an online ticket via the FinancialForce Community or by telephone, which is available daily from 6 a.m. to 6 p.m. PST, via a toll-free number. Response times vary, based on a user’s contracted support plan.

There are three different support plans: Standard, Premier, and Signature:

- With the Standard Success Plan, which is part of a standard subscription, FinancialForce will typically contact you within 48 business hours of initial ticket submission.

- For the Premier Success Plan, users will typically receive a response within one hour for a Business Standstill case, within two hours for a Business Critical case, and within six hours for any Major Problem, Problem and Question case.

- For the Signature Success Plan, users get a fast-track response within 15 minutes for a Business Standstill case, within one hour for a Business Critical case, and within two hours for any Major Problem, Problem and Question case.

Pricing

Pricing for FinancialForce is customizable to a business’ specific objectives. Each application can be bought individually or as a suite, meaning the pricing is flexible. Prospective clients need to contact FinancialForce directly for a price quote.

How Much Does an ERP System Cost?

Download our free report to compare pricing on 12 popular ERP Systems including NetSuite, SAP, Microsoft, and Odoo.Download NowShortcomings

When navigating between objects, users may encounter a delay. Some say the interface isn’t user-friendly and that configuring reports can be cumbersome.

However, because of its flexible functionality, and after intensive training and mastering the learning curve, most users recommend it.

Screenshots

About

FinancialForce is a leading cloud ERP and the No. 1 ERP solution native to the Salesforce platform. Founded in 2009, it’s backed by Salesforce Ventures, Technology Crossover Ventures, Advent International and UNIT4.

The company’s primary goal is to unify data across the enterprise in real-time, allowing companies to rapidly evolve their business models with customers at the center.

Download Comparison Guide