Vendor:

Founded:

Headquarters:

MIP

2013

Austin, TX

Customers:

Deployment Model:

Free Trial:

15,000+ users

Cloud, On-Premise

No

MIP Fund Acct'g At A Glance

Product Overview

MIP Fund Accounting (formerly Abila) is a configurable, true fund accounting software that allows nonprofit organizations and government agencies to more precisely manage their finances.

With up to 25 modules, MIP Fund Accounting can easily handle a variety of transaction types, including cash disbursements and receipts, allocations, bank reconciliations, recurring and routine general entries, order entry transactions and purchase orders. Also, firms can track costs, cash outflows and inflows, budget estimates, forecasts and reports in a single database. This allows for a great deal of accountability when a financial period ends and the analysis period begins.

Features

MIP Fund Accounting has 25 different modules users can choose from. Because the software is so versatile, it can empower organizations to make financial decisions with greater confidence.

Below are its key features:

- General ledger with report writer – The general ledger is the essential module that tracks journal vouchers, cash disbursements and receipts, and other financial transactions. Financial information can be tracked effectively using a segmented accounts chart. An intuitive report writer is contained within the solution.

- Data import/export – The core data import/export module allows organizations to minimize errors from manual data entry and avoid duplicate entry. In addition, it facilitates the transfer of transactions into the solution, such as accounts receivable details from specialized billing systems or general ledger entries from third-party payroll.

- Employee web services – MIP gives managers and personnel 24/7 web access to benefit information, pay records and critical messages. Several timesheet entry filters are offered, including the option to show only the employees for whom the user is the secondary supervisor, supervisor or manager. Employees can enter their time in a grid format, and the grid displays all valid wage code and cost-center combinations.

- Budget – MIP users can develop an unlimited number of personalized budgets for any period, such as cross-year budgets. Also, the budget module can be used to forecast and make “what-if” scenarios. In addition, it allows users to see how their transactions will affect the remaining budget in real time, with a budget view that’s directly present inside transaction entry.

Target Market

MIP’s software is built for small to mid-size associations, government agencies and nonprofit organizations. We’ve listed several of its clients below:

- Mariposa Community Health Center

- Community Action Partnership of Central Illinois

- Cunningham Children's Home

- Central Kansas Mental Health Center

- Water Replenishment District (Lakewood, CA)

- Humanities North Dakota

- Ponca Tribe of Nebraska

- University System of Georgia Foundation

- Georgia Public Library

- Plimoth Patuext Museums

Free Report: Accounting Software Buyer's Guide

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Choosing an Accounting Solution is all about finding the right fit. Our report will walk you through the process and help you make a smart purchasing decision. Download Now

Implementation/Integration

MIP’s software can be implemented as an on-premise, cloud-based or self-hosted solution. System requirements for each deployment are listed on MIP’s website.

Customer Service & Support

MIP’s support representatives respond to customers’ requests via its online support system (the vendor’s preferred method of receiving queries), complete with training guides, self-service webinars and a wiki that’s regularly updated. In addition, customers can contact the support staff by chat Monday to Friday from 8 a.m. to 5 p.m. CST (excluding holidays).

Pricing

MIP doesn’t publicly display pricing information, so please contact the vendor directly for a quote.

How Much Does Accounting Software Cost?

Download our free report to compare pricing on popular Accounting Solutions including AccountingEdge, Quickbooks, and Xero.Download NowShortcomings

Specific segments in MIP Fund Accounting can’t be altered once a company has set up a database. For instance, if an accountant previously used a three-digit fund code when creating the database, users from that company will remain limited to that decision. A new database must be created if users want to add a fourth digit.

Some users have also expressed their dissatisfaction over copy/paste features in certain modules. In the Budget module, for example, users can’t right click and paste. They need to choose “Edit” before pasting from the drop-down menu.

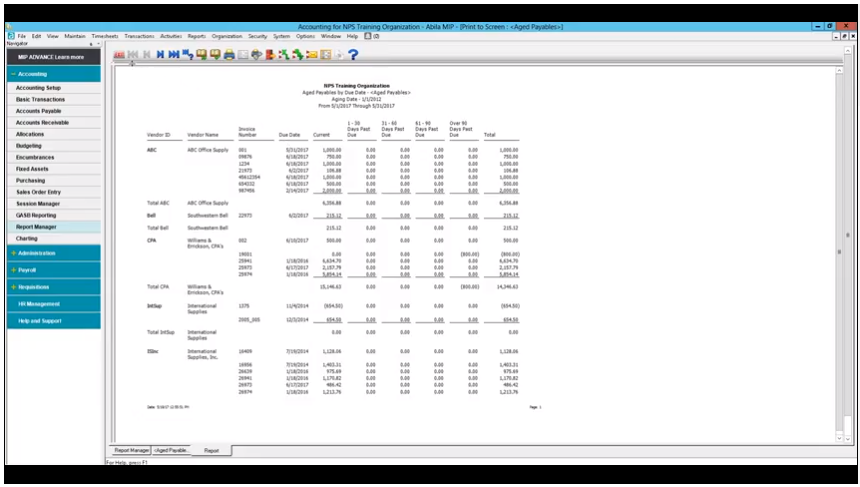

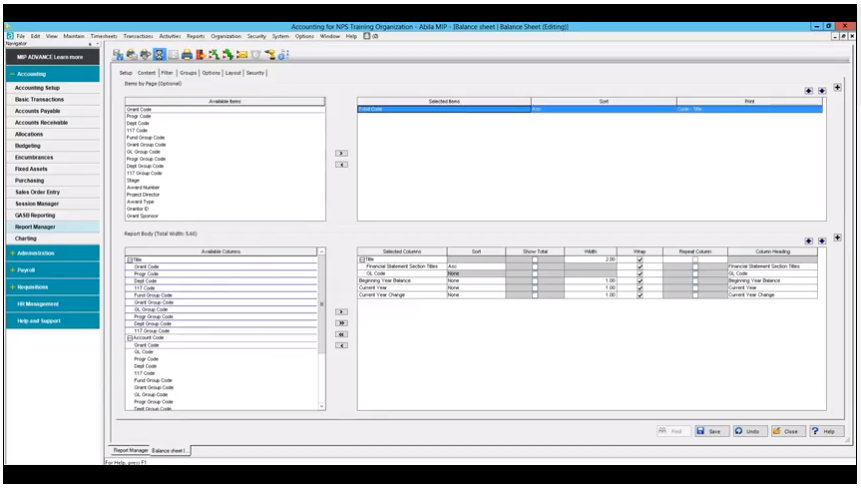

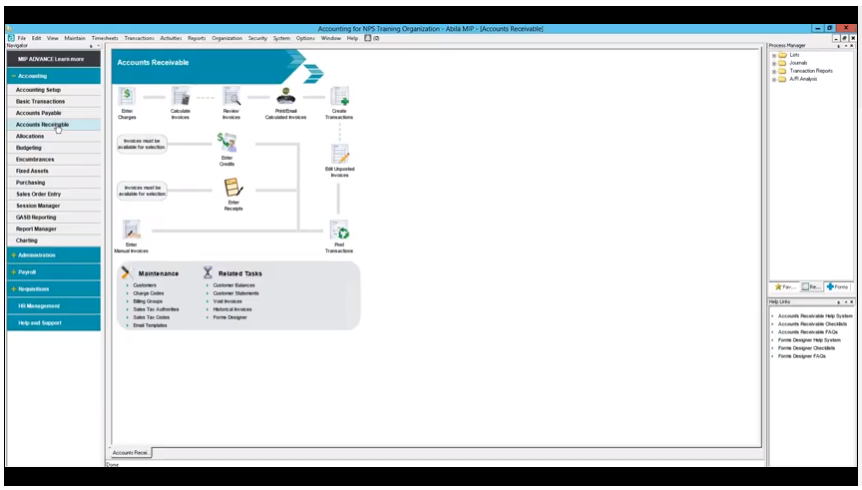

Screenshots

About

MIP is now part of the Community Brands family. Headquartered in St. Petersburg, FL, Community Brands is the leading provider of cloud-based software to associations, nonprofits, faith-based groups, and K-12 schools. Organizations adopt Community Brands software to manage memberships, career centers, learning, accounting, mobile giving, peer-to-peer fundraising, donations, admissions, enrollments and events. Using these solutions, customers of all sizes create meaningful and lasting experiences for their members, donors, students, and volunteers.

Download Comparison Guide